What is a Promissory Note for a Car?

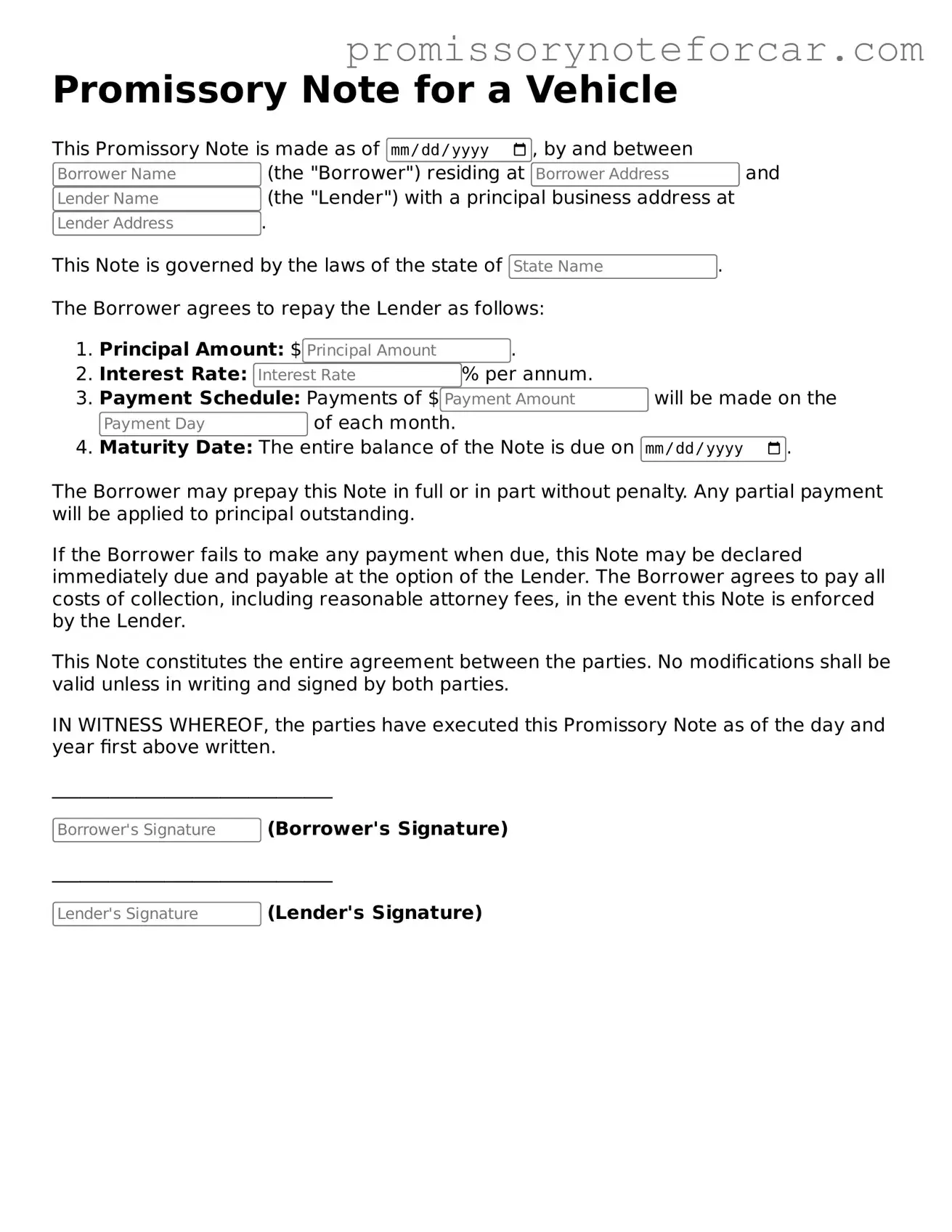

A Promissory Note for a Car is a legal document in which one party promises to pay a specific amount of money to another party. This note outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other relevant conditions. It serves as a written record of the agreement between the buyer and the seller or lender.

Why do I need a Promissory Note when buying a car?

Having a Promissory Note protects both the buyer and the seller. For the buyer, it provides proof of the loan agreement and outlines the repayment terms. For the seller or lender, it ensures that there is a clear understanding of the financial arrangement and a legal basis to seek repayment if necessary.

What information should be included in the Promissory Note?

The Promissory Note should include essential details such as the names and addresses of both parties, the amount of the loan, the interest rate, the repayment schedule, and any late fees or penalties for missed payments. Additionally, it should specify what happens in case of default, such as repossession of the car.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. This means that if one party fails to uphold their end of the agreement, the other party can take legal action to enforce the terms outlined in the note. It is important that both parties understand the terms before signing.

Do I need to have the Promissory Note notarized?

While notarization is not always required, it is often recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes over the validity of the agreement. It is a good practice to have a neutral third party witness the signing.

What happens if I default on the Promissory Note?

If you default on the Promissory Note, the lender may have the right to take legal action against you. This could include pursuing a court judgment to recover the owed amount or, in the case of a car loan, repossessing the vehicle. It is crucial to communicate with the lender if you are having trouble making payments.

Can I modify the terms of the Promissory Note after it has been signed?

Modifying the terms of a Promissory Note is possible, but it requires the agreement of both parties. Any changes should be documented in writing, and it is advisable to sign an amendment to the original note. This ensures that all parties are aware of and agree to the new terms.

What if I lose my copy of the Promissory Note?

If you lose your copy of the Promissory Note, it is important to notify the other party immediately. They may have a copy as well. You can also create a written statement acknowledging the loss and reaffirming the terms of the original agreement. This can help clarify any misunderstandings that may arise.

Can a Promissory Note be used for other types of loans?

Yes, a Promissory Note can be used for various types of loans beyond car purchases. It is a versatile document that can apply to personal loans, business loans, and more. The key is to ensure that all terms are clearly defined and agreed upon by both parties involved in the transaction.

Where can I find a template for a Promissory Note?

Templates for Promissory Notes can be found online through various legal websites and resources. However, it is advisable to tailor the template to your specific situation and, if necessary, consult with a legal professional to ensure that it meets all legal requirements and adequately protects your interests.